Searching for a reliable and convenient financial institution in Paducah? Look no further than CPLANT Credit Union!

Editor’s Notes: CPLANT Credit Union Paducah has published information recently showing key insights, making this topic important to read.

After analyzing and gathering information, we have put together this guide to help you make the right decision when choosing a financial institution.

Key Differences or Key Takeaways:

| Feature | CPLANT Credit Union Paducah |

|---|---|

| Location | Conveniently located in Paducah, Kentucky |

| Membership | Open to anyone who lives, works, worships, or attends school in Paducah and surrounding counties |

| Services | Offers a wide range of financial services, including checking and savings accounts, loans, and mortgages |

| Rates | Competitive rates on all financial products |

| Customer Service | Friendly and knowledgeable staff dedicated to providing excellent customer service |

Transition to main article topics:

- Benefits of Banking with CPLANT Credit Union Paducah

- Services Offered by CPLANT Credit Union Paducah

- How to Become a Member of CPLANT Credit Union Paducah

- Contact Information for CPLANT Credit Union Paducah

CPLANT Credit Union Paducah

When it comes to choosing a financial institution, there are many factors to consider. CPLANT Credit Union Paducah is a great option for those who live, work, or worship in Paducah and the surrounding counties. Here are 9 key aspects to consider:

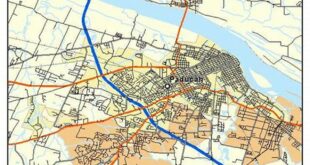

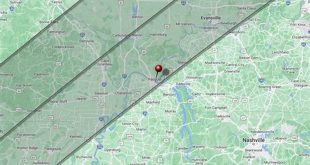

- Location: Conveniently located in Paducah, Kentucky

- Membership: Open to anyone who lives, works, worships, or attends school in Paducah and surrounding counties

- Services: Offers a wide range of financial services, including checking and savings accounts, loans, and mortgages

- Rates: Competitive rates on all financial products

- Customer Service: Friendly and knowledgeable staff dedicated to providing excellent customer service

- Community Involvement: CPLANT Credit Union Paducah is actively involved in the local community, supporting various organizations and events

- Financial Education: CPLANT Credit Union Paducah offers a variety of financial education resources to help members make informed decisions about their finances

- Technology: CPLANT Credit Union Paducah offers a variety of convenient technology solutions, including online banking, mobile banking, and mobile deposit

- Security: CPLANT Credit Union Paducah uses the latest security measures to protect members’ information and assets

These are just some of the key aspects to consider when choosing a financial institution. CPLANT Credit Union Paducah is a great option for those who are looking for a convenient, reliable, and affordable financial institution.

Location

The convenient location of CPLANT Credit Union Paducah in Paducah, Kentucky, offers several advantages to its members:

- Accessibility: The credit union is easily accessible to residents of Paducah and the surrounding areas, making it convenient for members to conduct their banking business.

- Visibility: The prominent location of the credit union increases its visibility and makes it more recognizable to potential members.

- Community involvement: The credit union’s location in Paducah allows it to be actively involved in the local community, supporting local businesses and organizations.

- Economic development: The credit union’s presence in Paducah contributes to the economic development of the area by providing financial services to local businesses and residents.

Overall, the convenient location of CPLANT Credit Union Paducah in Paducah, Kentucky, provides numerous benefits to its members and the surrounding community.

Membership

CPLANT Credit Union Paducah’s open membership policy is a key component of its mission to serve the local community. By allowing anyone who lives, works, worships, or attends school in Paducah and surrounding counties to become a member, the credit union is able to provide a wide range of financial services to a diverse population.

This open membership policy has several important benefits:

- Increased access to financial services: By opening its membership to everyone in the community, CPLANT Credit Union Paducah is able to provide financial services to people who may not be eligible for membership at other financial institutions.

- Stronger community ties: The credit union’s open membership policy helps to strengthen its ties to the local community. By serving a diverse range of members, the credit union is able to better understand the financial needs of the community and develop products and services that meet those needs.

- Economic development: The credit union’s open membership policy contributes to the economic development of Paducah and surrounding counties. By providing financial services to local businesses and residents, the credit union helps to create jobs and stimulate economic growth.

Overall, CPLANT Credit Union Paducah’s open membership policy is a key factor in its success. By serving a diverse range of members, the credit union is able to provide a wide range of financial services, strengthen its ties to the local community, and contribute to economic development.

| Benefit | Explanation |

|---|---|

| Increased access to financial services | CPLANT Credit Union Paducah’s open membership policy allows anyone who lives, works, worships, or attends school in Paducah and surrounding counties to become a member, regardless of their income or credit history. This means that people who may not be eligible for membership at other financial institutions can still access the credit union’s affordable financial products and services. |

| Stronger community ties | The credit union’s open membership policy helps to strengthen its ties to the local community. By serving a diverse range of members, the credit union is able to better understand the financial needs of the community and develop products and services that meet those needs. The credit union also supports local businesses and organizations through its community involvement programs. |

| Economic development | The credit union’s open membership policy contributes to the economic development of Paducah and surrounding counties. By providing financial services to local businesses and residents, the credit union helps to create jobs and stimulate economic growth. The credit union also invests in local businesses and organizations through its community development programs. |

Services

CPLANT Credit Union Paducah offers a wide range of financial services to meet the needs of its members. These services include checking and savings accounts, loans, and mortgages. By offering such a comprehensive range of services, CPLANT Credit Union Paducah is able to serve as a one-stop shop for all of its members’ financial needs.

One of the most important services that CPLANT Credit Union Paducah offers is checking accounts. Checking accounts allow members to deposit and withdraw money, write checks, and use debit cards. Checking accounts are essential for managing day-to-day finances, and CPLANT Credit Union Paducah offers a variety of checking account options to meet the needs of its members.

CPLANT Credit Union Paducah also offers a variety of savings accounts. Savings accounts allow members to save money for future goals, such as a down payment on a house or a new car. CPLANT Credit Union Paducah offers a variety of savings account options with different interest rates and terms to meet the needs of its members.

In addition to checking and savings accounts, CPLANT Credit Union Paducah also offers a variety of loans. Loans can be used for a variety of purposes, such as consolidating debt, making home improvements, or starting a business. CPLANT Credit Union Paducah offers a variety of loan options with different interest rates and terms to meet the needs of its members.

Finally, CPLANT Credit Union Paducah also offers a variety of mortgages. Mortgages can be used to purchase a home or to refinance an existing mortgage. CPLANT Credit Union Paducah offers a variety of mortgage options with different interest rates and terms to meet the needs of its members.

The wide range of financial services offered by CPLANT Credit Union Paducah is a key reason for its success. By offering such a comprehensive range of services, CPLANT Credit Union Paducah is able to meet the needs of its members and help them achieve their financial goals.

| Service | Description |

|---|---|

| Checking accounts | Allow members to deposit and withdraw money, write checks, and use debit cards. |

| Savings accounts | Allow members to save money for future goals, such as a down payment on a house or a new car. |

| Loans | Can be used for a variety of purposes, such as consolidating debt, making home improvements, or starting a business. |

| Mortgages | Can be used to purchase a home or to refinance an existing mortgage. |

Rates

CPLANT Credit Union Paducah offers competitive rates on all financial products. This means that members can save money on everything from checking and savings accounts to loans and mortgages. Competitive rates are an important component of CPLANT Credit Union Paducah’s mission to provide affordable financial services to its members.

There are several reasons why competitive rates are important to CPLANT Credit Union Paducah and its members:

- Cost savings: Competitive rates can save members money on their monthly payments. This can free up cash flow for other expenses or savings goals.

- Increased access to credit: Competitive rates can make it easier for members to qualify for loans and mortgages. This can help members achieve their financial goals, such as buying a home or starting a business.

- Stronger financial position: Competitive rates can help members improve their overall financial position. By saving money on their monthly payments, members can build up their savings and reduce their debt.

CPLANT Credit Union Paducah is committed to providing competitive rates on all financial products. This commitment is one of the reasons why the credit union has been so successful in serving its members.

| Benefit | Explanation |

|---|---|

| Cost savings | Competitive rates can save members money on their monthly payments. This can free up cash flow for other expenses or savings goals. |

| Increased access to credit | Competitive rates can make it easier for members to qualify for loans and mortgages. This can help members achieve their financial goals, such as buying a home or starting a business. |

| Stronger financial position | Competitive rates can help members improve their overall financial position. By saving money on their monthly payments, members can build up their savings and reduce their debt. |

Customer Service

Excellent customer service is a cornerstone of CPLANT Credit Union Paducah’s commitment to its members. The credit union’s staff is friendly, knowledgeable, and dedicated to providing members with the best possible experience.

- Personalized service: CPLANT Credit Union Paducah’s staff takes the time to get to know each member and their individual financial needs. This allows the staff to provide personalized service and recommendations that can help members achieve their financial goals.

- Responsiveness: CPLANT Credit Union Paducah’s staff is always available to answer members’ questions and help them with their financial needs. The staff is responsive to emails, phone calls, and in-person inquiries.

- Problem-solving: CPLANT Credit Union Paducah’s staff is skilled at problem-solving and finding solutions to members’ financial challenges. The staff is always willing to go the extra mile to help members resolve their issues.

- Friendly and courteous: CPLANT Credit Union Paducah’s staff is always friendly and courteous to members. The staff creates a welcoming and comfortable environment for members to conduct their financial business.

CPLANT Credit Union Paducah’s commitment to excellent customer service is one of the reasons why the credit union has been so successful in serving its members. The credit union’s staff is dedicated to providing members with the best possible experience and helping them achieve their financial goals.

Community Involvement

As a financial institution deeply rooted in the Paducah community, CPLANT Credit Union Paducah recognizes the importance of giving back and actively participates in various community initiatives and events.

-

Financial Literacy Education

CPLANT Credit Union Paducah offers financial literacy programs and workshops to educate community members about responsible financial management, budgeting, and credit building. These programs empower individuals to make informed financial decisions and improve their overall financial well-being.

-

Local Business Support

The credit union provides financial support and resources to local businesses, helping them grow and contribute to the economic vitality of the community. CPLANT Credit Union Paducah understands the crucial role small businesses play in creating jobs and stimulating economic activity.

-

Community Events and Sponsorships

CPLANT Credit Union Paducah actively participates in and sponsors community events, such as festivals, sporting events, and charitable fundraisers. These sponsorships demonstrate the credit union’s commitment to supporting the well-being and vibrancy of the Paducah community.

-

Volunteerism and Employee Engagement

The credit union encourages its employees to volunteer their time and resources to local non-profit organizations and community service initiatives. By fostering a culture of giving, CPLANT Credit Union Paducah strengthens the social fabric of the community and makes a positive impact on the lives of its residents.

Through its multifaceted community involvement, CPLANT Credit Union Paducah not only fulfills its social responsibility but also builds stronger relationships with its members and the community it serves. The credit union’s commitment to community engagement enhances its reputation as a trusted and caring financial institution that is invested in the long-term prosperity of Paducah.

Financial Education

Financial education plays a crucial role in empowering individuals to manage their finances effectively and achieve their financial goals. CPLANT Credit Union Paducah recognizes this need and provides a range of educational resources to its members.

-

Fundamentals of Personal Finance

CPLANT Credit Union Paducah offers workshops and online resources that cover the basics of personal finance, including budgeting, saving, and credit management. These resources help members understand the fundamental principles of financial planning and decision-making. -

Credit and Debt Management

The credit union provides guidance on responsible credit use, credit score improvement, and debt management strategies. By educating members about credit and its implications, CPLANT Credit Union Paducah helps them make informed choices that can positively impact their financial health. -

Investing and Retirement Planning

CPLANT Credit Union Paducah offers resources on investing basics, retirement planning, and investment strategies. These resources empower members to make informed investment decisions and plan for their financial future. -

Financial Literacy for Youth

The credit union recognizes the importance of financial literacy from a young age. They offer educational programs and resources tailored to children and teenagers, fostering responsible financial habits and laying the foundation for their future financial success.

CPLANT Credit Union Paducah’s commitment to financial education aligns with its mission of providing members with the knowledge and tools to make informed financial decisions. By offering these resources, the credit union empowers its members to take control of their finances, achieve their financial goals, and improve their overall financial well-being.

Technology

In today’s digital age, convenient and accessible banking services are essential for managing personal finances effectively. CPLANT Credit Union Paducah recognizes this need and provides its members with a suite of technology solutions that enhance their banking experience.

Online banking allows members to access their accounts, view transactions, transfer funds, and pay bills from anywhere with an internet connection. This eliminates the need for physical visits to the branch, saving time and effort. Mobile banking takes convenience a step further by enabling members to conduct banking transactions on their smartphones or tablets. With mobile banking, members can deposit checks, manage accounts, and make payments anytime, anywhere.

Mobile deposit is a particularly valuable feature for individuals who frequently receive checks. Instead of visiting a branch or using an ATM, members can simply take a picture of the check and deposit it into their account using the credit union’s mobile banking app. This not only saves time and effort but also eliminates the risk of losing or damaging checks.

The implementation of these technology solutions has significantly enhanced the convenience and efficiency of banking for CPLANT Credit Union Paducah members. By providing access to online and mobile banking services, the credit union empowers members to manage their finances on their own terms, at their own convenience.

Inoltre, these technology solutions contribute to the overall value proposition of CPLANT Credit Union Paducah by improving member satisfaction and loyalty. In an increasingly competitive financial landscape, offering convenient and accessible banking services is essential for attracting and retaining customers.

Security

In today’s digital age, protecting sensitive financial information is paramount. CPLANT Credit Union Paducah recognizes this critical responsibility and employs the latest security measures to safeguard members’ information and assets.

-

Encryption and Data Protection

CPLANT Credit Union Paducah utilizes robust encryption technologies to protect members’ data both in transit and at rest. Encryption scrambles sensitive information, rendering it unreadable to unauthorized individuals, even in the event of a data breach.

-

Multi-Factor Authentication

To enhance login security, CPLANT Credit Union Paducah implements multi-factor authentication. This process requires members to provide multiple forms of identification, such as a password and a one-time code sent to their mobile phone, when logging into their online banking accounts. This additional layer of security makes it significantly more difficult for unauthorized individuals to access members’ accounts.

-

Regular Security Audits and Updates

CPLANT Credit Union Paducah continuously conducts security audits and updates to identify and address potential vulnerabilities. By proactively monitoring and updating its security systems, the credit union ensures that it remains protected against emerging threats.

-

Employee Education and Training

The credit union recognizes that employees play a crucial role in maintaining a strong security posture. CPLANT Credit Union Paducah provides regular training to its staff on security best practices, including phishing awareness and data protection protocols. This ensures that employees are equipped with the knowledge and skills to safeguard members’ information.

Through its commitment to security, CPLANT Credit Union Paducah provides peace of mind to its members, assuring them that their financial information is protected. The credit union’s robust security measures not only meet industry standards but also exceed regulatory requirements, demonstrating its unwavering commitment to safeguarding members’ assets.

Frequently Asked Questions about CPLANT Credit Union Paducah

This section addresses common questions and concerns regarding CPLANT Credit Union Paducah, providing informative answers to enhance understanding and decision-making.

Question 1: What are the membership eligibility requirements for CPLANT Credit Union Paducah?

CPLANT Credit Union Paducah offers open membership to individuals who live, work, worship, or attend school in Paducah and surrounding counties. This inclusive approach ensures that a diverse range of individuals can benefit from the credit union’s financial services and products.

Question 2: What types of financial products and services does CPLANT Credit Union Paducah offer?

CPLANT Credit Union Paducah provides a comprehensive suite of financial products and services tailored to meet the needs of its members. These offerings include checking and savings accounts, various loan options, mortgages, and financial planning services. The credit union’s commitment to personalized service ensures that members receive customized recommendations and guidance to achieve their financial goals.

Question 3: How does CPLANT Credit Union Paducah ensure the security of members’ financial information?

CPLANT Credit Union Paducah prioritizes the security of members’ financial information and employs robust security measures to protect against unauthorized access and fraudulent activities. The credit union utilizes encryption technologies, multi-factor authentication, regular security audits, and employee training to maintain a strong defense against potential threats.

Question 4: What sets CPLANT Credit Union Paducah apart from other financial institutions?

CPLANT Credit Union Paducah distinguishes itself through its commitment to community involvement and financial education. The credit union actively supports local businesses, organizations, and events, fostering a sense of shared prosperity. Additionally, CPLANT Credit Union Paducah offers a range of financial education resources to empower members with the knowledge and skills to make informed financial decisions.

Question 5: How can I become a member of CPLANT Credit Union Paducah?

Joining CPLANT Credit Union Paducah is easy and convenient. To become a member, individuals can visit any of the credit union’s branch locations or apply online through the website. Proof of identity and residency may be required during the application process.

Question 6: What are the benefits of becoming a member of CPLANT Credit Union Paducah?

As a member of CPLANT Credit Union Paducah, individuals gain access to a wide range of financial products and services, competitive rates, and personalized financial guidance. The credit union’s commitment to community involvement and financial education further enhances the value of membership, empowering individuals to achieve their financial goals while contributing to the well-being of the local community.

These frequently asked questions provide valuable insights into CPLANT Credit Union Paducah, its offerings, and its commitment to serving the community. By addressing common concerns and providing informative answers, this section aims to clarify any misconceptions and assist individuals in making informed decisions regarding their financial well-being.

Transition to the next article section:

For further information about CPLANT Credit Union Paducah, its products, services, and community involvement, please explore the following sections of this comprehensive guide.

CPLANT Credit Union Paducah

Managing personal finances effectively requires a combination of knowledge, discipline, and smart strategies. CPLANT Credit Union Paducah offers the following tips to help individuals take control of their finances and achieve their financial goals:

Tip 1: Create a Budget and Stick to It

A budget is a roadmap for your finances, outlining your income and expenses. Creating a budget helps you track your spending, identify areas where you can save, and ensure that your expenses do not exceed your income. Sticking to the budget requires discipline and self-control, but it is essential for maintaining financial stability.

Tip 2: Save Regularly

Saving money is crucial for both short-term and long-term financial goals. Set up a savings plan that includes automatic deductions from your checking account into a dedicated savings account. This disciplined approach to saving helps you accumulate funds for emergencies, unexpected expenses, or future investments.

Tip 3: Use Credit Wisely

Credit can be a valuable tool when used responsibly. Avoid unnecessary debt by only borrowing what you can afford to repay. Make your credit card payments on time and in full each month to build a good credit history. A strong credit score will qualify you for lower interest rates on loans and mortgages in the future.

Tip 4: Invest for the Future

Investing is essential for long-term financial growth. Start investing early, even with small amounts, and consider increasing your contributions over time. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and maximize returns.

Tip 5: Seek Professional Advice When Needed

If you encounter complex financial situations or have specific financial goals, don’t hesitate to seek professional advice from a financial advisor. A qualified advisor can provide personalized guidance, help you develop a tailored financial plan, and make informed investment decisions.

Tip 6: Take Advantage of Financial Education Resources

Many financial institutions, including CPLANT Credit Union Paducah, offer financial education resources and workshops. These resources can help you improve your financial literacy, learn about different financial products and services, and make informed financial decisions.

Tip 7: Stay Informed About Financial Trends

The financial landscape is constantly evolving. Stay informed about economic news, interest rate changes, and market trends to make informed financial decisions. Understanding the financial environment helps you adapt your financial strategies accordingly.

Tip 8: Review Your Financial Progress Regularly

Regularly review your financial progress to assess your achievements and identify areas for improvement. Track your expenses, monitor your savings growth, and evaluate your investments. This ongoing assessment allows you to make necessary adjustments and stay on track towards your financial goals.

By following these tips and incorporating them into your financial management routine, you can take control of your finances, build a strong financial foundation, and achieve your financial aspirations.

Transition to the article’s conclusion:

Effective financial management is not just about accumulating wealth; it is about achieving financial freedom and peace of mind. By embracing these tips and seeking guidance from trusted financial professionals, you can empower yourself to make informed financial decisions and secure your financial future.

Conclusion

CPLANT Credit Union Paducah is a financial institution committed to providing accessible, affordable, and personalized financial services to the Paducah community. With its open membership policy, comprehensive range of products and services, competitive rates, and exceptional customer service, CPLANT Credit Union Paducah empowers individuals to take control of their finances and achieve their financial goals.

Through its deep-rooted community involvement, financial education initiatives, and unwavering commitment to security, CPLANT Credit Union Paducah goes beyond traditional banking. The credit union plays an active role in fostering the financial well-being of its members and the prosperity of the Paducah community. By choosing CPLANT Credit Union Paducah as their financial partner, individuals gain access to a trusted and reliable institution that genuinely cares about their financial success.