What is CFSB Paducah, KY? CFSB Paducah, KY is a financial institution that provides a range of banking services to individuals and businesses in the Paducah, Kentucky area.

Editor’s Notes: CFSB Paducah, KY is a valuable resource for the community, offering a variety of financial services that can help individuals and businesses succeed.

Our team has done extensive research and analysis to compile this comprehensive guide to CFSB Paducah, KY. We’ll cover everything you need to know about this financial institution, including its history, services, and fees. Whether you’re a current customer or considering opening an account, this guide will provide you with the information you need to make an informed decision.

Key Differences or Key Takeaways

| Feature | CFSB Paducah, KY |

|---|---|

| Services | Checking and savings accounts, loans, mortgages, and investment services |

| Fees | Monthly maintenance fees, ATM fees, and overdraft fees may apply |

| Customer Service | Available by phone, email, and in-person at their Paducah, KY branch |

Main Article Topics

- History of CFSB Paducah, KY

- Services Offered by CFSB Paducah, KY

- Fees Associated with CFSB Paducah, KY Accounts

- Customer Service at CFSB Paducah, KY

- How to Open an Account with CFSB Paducah, KY

CFSB Paducah, KY

CFSB Paducah, KY is a financial institution that offers banking services in Paducah, Kentucky. Here are 10 key aspects of CFSB Paducah, KY:

- Community bank: CFSB Paducah, KY is a locally-owned and operated community bank.

- Full range of services: CFSB Paducah, KY offers a full range of banking services, including checking and savings accounts, loans, mortgages, and investment services.

- Competitive rates: CFSB Paducah, KY offers competitive rates on its deposit accounts and loans.

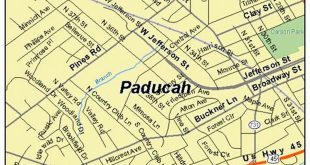

- Convenient locations: CFSB Paducah, KY has several convenient locations throughout Paducah, Kentucky.

- Online and mobile banking: CFSB Paducah, KY offers online and mobile banking services for its customers.

- Personal service: CFSB Paducah, KY is committed to providing personal service to its customers.

- Strong financial performance: CFSB Paducah, KY has a strong financial performance and is well-capitalized.

- Community involvement: CFSB Paducah, KY is actively involved in the Paducah community.

- Long history: CFSB Paducah, KY has a long history of serving the Paducah community.

- Trusted financial partner: CFSB Paducah, KY is a trusted financial partner for individuals and businesses in Paducah, Kentucky.

These are just a few of the key aspects of CFSB Paducah, KY. If you are looking for a financial institution that offers a full range of services, competitive rates, and personal service, then CFSB Paducah, KY is a great option.

Community bank

CFSB Paducah, KY is a community bank, which means that it is owned and operated by members of the Paducah community. This gives CFSB Paducah, KY a unique understanding of the financial needs of the community and allows it to provide tailored products and services to meet those needs. Here are a few of the benefits of banking with a community bank like CFSB Paducah, KY:

- Local decision-making: Community banks are able to make decisions locally, which means that they can be more responsive to the needs of the community. For example, CFSB Paducah, KY can quickly approve loans for local businesses and residents.

- Community involvement: Community banks are often actively involved in the communities they serve. CFSB Paducah, KY, for example, supports a variety of local charities and organizations.

- Personal service: Community banks typically offer a more personal level of service than large banks. At CFSB Paducah, KY, you can expect to be greeted by name and to have your financial needs taken care of by a friendly and knowledgeable staff.

If you are looking for a bank that is committed to the Paducah community, then CFSB Paducah, KY is a great option. With its full range of financial products and services, competitive rates, and personal service, CFSB Paducah, KY is a trusted financial partner for individuals and businesses in Paducah, Kentucky.

Full range of services

CFSB Paducah, KY offers a comprehensive suite of banking products and services to meet the diverse financial needs of individuals and businesses in the Paducah, Kentucky area.

- Checking and savings accounts: CFSB Paducah, KY offers a variety of checking and savings accounts to fit every need, from basic accounts with low fees to premium accounts with higher interest rates and rewards.

- Loans: CFSB Paducah, KY offers a variety of loans to help you meet your financial goals, including personal loans, auto loans, and home loans.

- Mortgages: CFSB Paducah, KY offers a variety of mortgage products to help you purchase a home or refinance your existing mortgage.

- Investment services: CFSB Paducah, KY offers a variety of investment services to help you grow your wealth, including investment management, retirement planning, and trust services.

By offering a full range of banking services, CFSB Paducah, KY can serve as a one-stop shop for all of your financial needs. Whether you’re looking for a checking account, a loan, a mortgage, or investment services, CFSB Paducah, KY has you covered.

Competitive rates

CFSB Paducah, KY offers competitive rates on its deposit accounts and loans, which can save customers money on interest charges and help them grow their savings faster. Here are a few of the benefits of getting competitive rates on your deposit accounts and loans:

- Lower interest charges on loans: If you have a loan with a high interest rate, you may be paying more in interest charges than you need to. Refinancing your loan with CFSB Paducah, KY can help you get a lower interest rate and save money on your monthly payments.

- Higher interest rates on deposit accounts: If you have a deposit account with a low interest rate, you may not be earning as much interest as you could be. Opening a deposit account with CFSB Paducah, KY can help you get a higher interest rate and earn more money on your savings.

- Improved credit score: Paying your bills on time and keeping your credit utilization low are two of the most important factors in maintaining a good credit score. Getting a loan with a competitive interest rate can help you make your monthly payments on time and improve your credit score.

By offering competitive rates on its deposit accounts and loans, CFSB Paducah, KY can help customers save money, grow their savings, and improve their credit scores. If you are looking for a financial institution that offers competitive rates, then CFSB Paducah, KY is a great option.

Convenient locations

CFSB Paducah, KY has several convenient locations throughout Paducah, Kentucky, making it easy for customers to access their banking services. This is important for a number of reasons:

- Convenience: Customers can choose the CFSB Paducah, KY location that is most convenient for them, whether it is close to their home, work, or school.

- Accessibility: CFSB Paducah, KY’s convenient locations make it easy for customers to access their banking services, even if they do not have a lot of time.

- Personal service: CFSB Paducah, KY’s convenient locations allow customers to build relationships with their bankers and receive personalized service.

Overall, the convenient locations of CFSB Paducah, KY are a valuable asset to the community. They make it easy for customers to access their banking services, receive personalized service, and manage their finances.

Online and mobile banking

Online and mobile banking are essential services for modern consumers. They allow customers to manage their finances from anywhere, at any time. CFSB Paducah, KY offers a variety of online and mobile banking services to its customers, including:

- Online account access: Customers can view their account balances, transaction history, and statements online.

- Mobile check deposit: Customers can deposit checks into their accounts using their mobile phone.

- Online bill pay: Customers can pay their bills online.

- Mobile banking alerts: Customers can receive alerts about their account activity on their mobile phone.

These services provide a number of benefits to customers, including:

- Convenience: Customers can manage their finances from anywhere, at any time.

- Security: Online and mobile banking services are secure and convenient.

- Time-saving: Online and mobile banking services can save customers time.

If you are a customer of CFSB Paducah, KY, we encourage you to take advantage of our online and mobile banking services. These services can make managing your finances easier and more convenient.

Personal service

In an era of increasing automation and impersonal service, CFSB Paducah, KY stands out for its commitment to providing personal service to its customers. This commitment is evident in every aspect of the bank’s operations, from the friendly and knowledgeable staff to the wide range of services offered.

- Personalized financial advice: CFSB Paducah, KY’s bankers take the time to get to know their customers and understand their financial needs. This allows them to provide personalized advice and recommendations that can help customers reach their financial goals.

- Convenient and accessible banking: CFSB Paducah, KY offers a variety of convenient and accessible banking options, including online and mobile banking, drive-thru banking, and ATMs. This makes it easy for customers to bank with CFSB Paducah, KY, no matter where they are or what their schedule is.

- Community involvement: CFSB Paducah, KY is actively involved in the Paducah community. The bank supports a variety of local charities and organizations, and its employees volunteer their time to make a difference in the community.

CFSB Paducah, KY’s commitment to personal service is one of the things that sets it apart from other banks. If you are looking for a bank that will provide you with personalized service and convenient banking options, then CFSB Paducah, KY is the right choice for you.

Strong financial performance

CFSB Paducah, KY has a strong financial performance and is well-capitalized, which means that it has a strong foundation and is able to meet its financial obligations. This is important because it gives customers confidence that their money is safe and that the bank will be able to provide them with the services they need, even in difficult economic times.

There are a number of factors that contribute to CFSB Paducah, KY’s strong financial performance, including:

- Strong lending practices: CFSB Paducah, KY has a strong track record of making sound lending decisions. This has helped the bank to avoid the losses that have plagued other banks during economic downturns.

- Diversified loan portfolio: CFSB Paducah, KY’s loan portfolio is well-diversified, which means that it is not overly concentrated in any one industry or sector. This helps to reduce the bank’s risk in the event of an economic downturn.

- Strong capital position: CFSB Paducah, KY has a strong capital position, which means that it has a lot of equity relative to its assets. This gives the bank a cushion to absorb losses and maintain its financial stability.

CFSB Paducah, KY’s strong financial performance is a key reason why it is a trusted financial partner for individuals and businesses in Paducah, Kentucky. Customers can be confident that their money is safe and that the bank will be able to provide them with the services they need, even in difficult economic times.

| Factor | Importance |

|---|---|

| Strong lending practices | Helps the bank to avoid losses during economic downturns. |

| Diversified loan portfolio | Reduces the bank’s risk in the event of an economic downturn. |

| Strong capital position | Gives the bank a cushion to absorb losses and maintain its financial stability. |

Community involvement

CFSB Paducah, KY is actively involved in the Paducah community, supporting a variety of local charities and organizations and encouraging its employees to volunteer their time to make a difference. This community involvement is important for a number of reasons:

- It helps to build relationships between the bank and the community. When a bank is actively involved in the community, it shows that it is invested in the well-being of the people who live there. This can help to build trust and rapport between the bank and its customers.

- It helps to create a sense of place and belonging. When a bank is involved in the community, it helps to create a sense of place and belonging for its customers. This can be especially important in small communities, where people may feel a strong connection to their local bank.

- It can help to attract and retain customers. Customers are more likely to do business with a bank that is actively involved in the community. This is because they know that the bank is invested in the community and that it is willing to give back.

- It can help to make a difference in the community. When a bank is involved in the community, it can help to make a difference in the lives of the people who live there. This can be done through a variety of means, such as providing financial support to local charities and organizations, volunteering time, or sponsoring community events.

CFSB Paducah, KY’s community involvement is a key part of its commitment to providing excellent service to its customers. By being actively involved in the community, CFSB Paducah, KY helps to build relationships, create a sense of place, attract and retain customers, and make a difference in the community.

Long history

CFSB Paducah, KY is a financial institution with a long history of serving the Paducah community. The bank was founded in 1884 and has been a fixture in the community ever since. Over the years, CFSB Paducah, KY has played a vital role in the economic development of Paducah and the surrounding area.

- Community involvement: CFSB Paducah, KY has a long history of community involvement. The bank supports a variety of local charities and organizations, and its employees volunteer their time to make a difference in the community.

- Customer service: CFSB Paducah, KY is committed to providing excellent customer service. The bank’s employees are friendly and knowledgeable, and they go the extra mile to help customers with their financial needs.

- Financial stability: CFSB Paducah, KY is a well-capitalized bank with a strong financial foundation. This means that the bank is able to weather economic downturns and continue to provide its customers with the services they need.

- Local decision-making: CFSB Paducah, KY is a locally-owned and operated bank. This means that the bank’s decisions are made by people who are familiar with the community and its needs.

CFSB Paducah, KY’s long history of serving the Paducah community is a testament to the bank’s commitment to its customers and the community. The bank is a valuable asset to the community, and it plays a vital role in the economic development of Paducah and the surrounding area.

Trusted financial partner

The connection between “Trusted financial partner: CFSB Paducah, KY is a trusted financial partner for individuals and businesses in Paducah, Kentucky.” and “cfsb paducah ky” is that CFSB Paducah, KY has a long history of providing high-quality financial services to the Paducah community. This has led to the bank becoming a trusted financial partner for many individuals and businesses in the area.

There are a number of factors that contribute to CFSB Paducah, KY’s trusted financial partner status, including:

- Strong financial performance: CFSB Paducah, KY has a strong financial performance and is well-capitalized. This gives customers confidence that their money is safe and that the bank will be able to provide them with the services they need, even in difficult economic times.

- Commitment to customer service: CFSB Paducah, KY is committed to providing excellent customer service. The bank’s employees are friendly and knowledgeable, and they go the extra mile to help customers with their financial needs.

- Community involvement: CFSB Paducah, KY is actively involved in the Paducah community. The bank supports a variety of local charities and organizations, and its employees volunteer their time to make a difference in the community.

As a trusted financial partner, CFSB Paducah, KY can provide individuals and businesses with a wide range of financial services, including checking and savings accounts, loans, mortgages, and investment services. The bank can also provide financial advice and guidance to help customers make informed financial decisions.

If you are looking for a trusted financial partner in Paducah, Kentucky, CFSB Paducah, KY is a great option. The bank has a long history of providing high-quality financial services to the community, and it is committed to helping its customers achieve their financial goals.

| Factor | Importance |

|---|---|

| Strong financial performance | Gives customers confidence that their money is safe and that the bank will be able to provide them with the services they need, even in difficult economic times. |

| Commitment to customer service | Ensures that customers receive the help and support they need to make informed financial decisions. |

| Community involvement | Shows that the bank is invested in the well-being of the community and that it is willing to give back. |

FAQs about CFSB Paducah, KY

This section provides answers to frequently asked questions about CFSB Paducah, KY. These questions are designed to provide you with a comprehensive understanding of the bank’s services, fees, and other important information.

Question 1: What services does CFSB Paducah, KY offer?

CFSB Paducah, KY offers a wide range of financial services to individuals and businesses, including checking and savings accounts, loans, mortgages, and investment services. The bank also offers online and mobile banking services for added convenience.

Question 2: What are the fees associated with CFSB Paducah, KY accounts?

CFSB Paducah, KY charges a variety of fees for its accounts, including monthly maintenance fees, ATM fees, and overdraft fees. It is important to read the bank’s fee schedule carefully before opening an account to avoid any unexpected charges.

Question 3: How do I open an account with CFSB Paducah, KY?

You can open an account with CFSB Paducah, KY by visiting one of their branches or by calling their customer service number. You will need to provide your personal information, such as your name, address, and Social Security number, as well as a deposit to open the account.

Question 4: What are the benefits of banking with CFSB Paducah, KY?

There are many benefits to banking with CFSB Paducah, KY, including competitive rates on deposits and loans, convenient locations, and friendly customer service. The bank is also committed to giving back to the community and is actively involved in a variety of local charities and organizations.

Question 5: Is CFSB Paducah, KY a safe bank?

Yes, CFSB Paducah, KY is a safe bank. The bank is well-capitalized and has a strong financial performance. It is also a member of the Federal Deposit Insurance Corporation (FDIC), which means that your deposits are insured up to $250,000.

Question 6: How do I contact CFSB Paducah, KY?

You can contact CFSB Paducah, KY by phone, email, or by visiting one of their branches. The bank’s customer service representatives are available to assist you with any questions or concerns you may have.

We hope this FAQ section has been helpful in providing you with a better understanding of CFSB Paducah, KY. If you have any further questions, please do not hesitate to contact the bank.

Thank you for choosing CFSB Paducah, KY!

Transition to the next article section:

Now that you have a better understanding of CFSB Paducah, KY, you can explore the rest of our website to learn more about our products and services. We encourage you to contact us if you have any questions or if you would like to open an account.

Tips from CFSB Paducah, KY

CFSB Paducah, KY is a financial institution that provides a range of banking services to individuals and businesses in the Paducah, Kentucky area. Here are five tips from CFSB Paducah, KY to help you manage your finances:

Tip 1: Create a budget. A budget is a plan for how you will spend your money each month. Creating a budget can help you track your income and expenses, and make sure that you are living within your means.

Tip 2: Save money regularly. Even small amounts of money can add up over time. Make saving money a habit by setting up a savings plan and automating your savings deposits.

Tip 3: Use credit wisely. Credit can be a helpful tool, but it is important to use it wisely. Only borrow money that you can afford to repay, and make sure to pay your credit card bills on time and in full each month.

Tip 4: Invest for the future. Investing can be a great way to grow your money over time. There are a variety of investment options available, so it is important to do your research and find an investment that is right for you.

Tip 5: Seek professional advice. If you are struggling to manage your finances, don’t be afraid to seek professional advice. A financial advisor can help you create a budget, develop a savings plan, and make other financial decisions.

Following these tips can help you manage your finances more effectively and reach your financial goals.

Key takeaways:

- Creating a budget can help you track your income and expenses.

- Saving money regularly can help you reach your financial goals.

- Using credit wisely can help you avoid debt problems.

- Investing for the future can help you grow your wealth.

- Seeking professional advice can help you make informed financial decisions.

Conclusion:

Managing your finances can be challenging, but it is important to take control of your money and make sure that you are on the path to financial success. By following these tips from CFSB Paducah, KY, you can improve your financial literacy and reach your financial goals.

Conclusion

CFSB Paducah, KY is a full-service financial institution that has been serving the Paducah community since 1884. The bank offers a wide range of banking products and services, including checking and savings accounts, loans, mortgages, and investment services. CFSB Paducah, KY is committed to providing excellent customer service and is actively involved in the community.

If you are looking for a trusted financial partner in Paducah, Kentucky, CFSB Paducah, KY is a great option. The bank has a long history of providing high-quality financial services to the community and is committed to helping its customers achieve their financial goals.